Need to remortgage but left it until the last minute?

With interest rates higher than they have been for 15 years, you may be worried about the impact this will have on your monthly mortgage payments once your current mortgage deal expires.

There is no doubt it can feel overwhelming for homeowners at a time when it’s hard to turn on the news without hearing about increased interest rates, increased living costs and ever-changing mortgage rates. If you don’t know which way to turn and you’ve left remortgaging until the last minute - don’t panic!

Before you hit the panic button, talk to your mortgage adviser.

It’s important to look beyond these headlines and don’t assume that the worst-case scenario will necessarily apply to you. Talking to an adviser as soon as you can is crucial to avoid rushing and potentially ending up with a less favourable deal.

If you haven’t got a new deal in place when your fixed rate mortgage ends, your lender will put you onto their standard variable rate, which tends to be higher than the rates on most other mortgage options. So it pays to get the right mortgage for you in place.

We will assess all your options, advise you on which is most suitable and support you throughout the application process. We can search an extensive panel of lenders for you, finding deals and options that you may not have even considered. We're ideally placed to check what your current lender will offer you and what you could get elsewhere.

Worried you won’t qualify for a remortgage?

Everyone’s circumstances change over time! Don’t worry if you’ve had a credit blip, you’re earning less or your property has dropped in value, because that doesn’t mean you’re automatically stuck for choice. Your options are out there, and with an experienced adviser at your side, you’ll be able to find them.

Our expert advice will make your mortgage search and application process pain-free, so don’t panic that you’ve left it until the last minute, speak to us today.

By seeking advice from a mortgage adviser now, you could get the right deal for you sooner.

Call Will on 07778 844 842 or David on 07774 127 179

alternatively, drop us an email on wbeach@finhawkmortgages.co.uk

|

Your home may be repossessed if you do not keep up repayments on your mortgage. |

Approved by The Openwork Partnership on 07/09/2023

Should I consider private medical insurance?

Life can be full of surprises. You can’t be prepared for everything. You may have some insurance to support you financially if the unexpected happens, but have you considered how private medical insurance might offer you and your family the peace of mind you need if your health takes a turn for the worst?

A growing trend

According to data published by The Telegraph, close to half a million people have taken out private medical insurance over the past year, as NHS waiting lists hit record levels this autumn. According to government statistics almost 7.8 million people were waiting to start routine hospital treatment in September 2023.

Against this backdrop, it’s hardly a surprise that more people than ever are considering the benefits of private medical insurance including faster access to medical treatment for themselves and their families.

It’s not just speed of access, it’s also about the quality of care you receive, the flexibility of choosing where and when you would like to receive treatment, and the range of treatments, medicines, facilities and consultants available to you. Cost-restrictions in an already stretched NHS mean that not all breakthrough treatments are accessible. With private medical insurance you can sleep easy, safe in the knowledge that the very best care is available.

It’s more affordable than you think

Avoiding lengthy waits for treatment and quality of care are just two of the biggest attractions of taking a route which has traditionally been seen as too expensive for most. But through our specially selected health insurance partner we can help you find the right policy for your budget. If you already have private medical insurance, we may be able to find you cheaper premiums for your circumstances, and all with a free no obligation quote.

The pandemic provided a reminder to us all of just how precious good health is – and acted as a reset for many. Health became a priority, and continues to be so. Spending money on private medical insurance may not have previously been a priority but protecting you and your family over the long-term means a growing number of people are taking the time to consider a more proactive approach to getting the treatment they may need.

We love our NHS but we know the pressure it’s under

We have nothing but respect for the hard-working and talented individuals who make the NHS what it is. But we also know that the service that has given so much to so many is under unprecedented pressure. We also know that there is often a faster and better alternative.

We can make sure you get all the information you need to decide whether private health insurance is the right option for you.

Call Will on 07778 844842 or drop us an email on wbeach@finhawkmortgages.co.uk

Approved by The Openwork Partnership on 30/10/2023

A little change you can make today can safeguard your biggest investment – your home

If you’re a homeowner, your mortgage payments are likely to take up a large part of your income each month.

You’ve made sure that your loved-ones will have financial protection to cover the mortgage you leave behind if you were to die with life insurance but what about if you became seriously ill or injured, and unable to work? Would you be able to keep up your mortgage repayments?

Statistically, you’re much more likely to be diagnosed with a critical illness than die during your working life. For example, a man aged 40 is 4.1 times more likely to be diagnosed with a critical illness than die before retiring at 65 years old.

As buying a home is likely to be your biggest investment, it pays to protect yourself, so you’re covered should you die as well as if you become too ill to work.

We know the little things in life can be life-changing. It could be a phone call from the doctor with serious news about your health, or a stepladder that wobbled once too often when you were standing on it – serious illness and injury can happen when we’re least expecting it.

How would you pay your mortgage if you were too ill to work?

There are different types of insurance available which can provide financial protection. These include income protection which provides a monthly income if you’re too ill to work and critical illness which pays out a tax-free lump sum if you’re diagnosed with a specific serious illness or injury.

It will be a huge relief to you and your loved-ones to know that you will still be able to pay your mortgage and other essential bills if you are too ill to work, leaving you to focus on what’s important – getting better.

Here’s one little thing you can do to protect your financial future, so get in touch with an adviser from Finhawk Mortgages Ltd today

Your different options can be discussed with your adviser – so you can make sure you have the right protection in place for you and your family.

Call David on 07774 127179 or drop him an email on dbeach@finhawkmortgages.co.uk

Approved by The Openwork Partnership on 11/07/2023.

Worried about mortgage lenders withdrawing their products and deals?

Worried about mortgage lenders withdrawing their products and deals?

The mortgage market is going through another unpredictable time with mortgage lenders withdrawing mortgage deals and increasing rates in a reaction to the recent news that inflation is slowing at a less-than-expected rate.

Do you need to remortgage now?

If you’re due to remortgage now, don’t panic! The good news is that help is at hand.

Despite the recent withdrawal of some mortgage products and rates, we still have access to thousands of mortgage rates and can search an extensive panel of lenders for you, finding deals and options that you may not have even considered. We’ll also be saving you hours of searching time and mortgage comparison headaches.

Speaking to an adviser can help during these unpredictable times

If you’re worried about remortgaging, seek mortgage advice from an expert. We have our fingers on the pulse of the mortgage market and are equipped with in-depth knowledge of the different mortgage products on offer. Our insider knowledge can make your remortgaging process simple, so are you ready to find the right mortgage for you? Speak to us today.

Call David on 07774 127179 or drop us an email to dbeach@finhawkmortgages.co.uk

Your home may be repossessed if you do not keep up repayments on your mortgage.

Approved by The Openwork Partnership on 12/06/2023

Life after your fixed rate mortgage. Should you stay with your lender?

Staying with your current lender may feel like the safest option when your mortgage comes to an end, but that’s no guarantee that you’ll be getting the best deal. That’s why we recommend shopping around to get a mortgage that’s fits you.

When there is such uncertainty in the housing market at the moment, you might be thinking that staying put is the right thing to do. It may feel like the easiest, but unless you search the mortgage market thoroughly, you won’t know for certain that you’re on a mortgage deal that is the right deal for you. And staying with your lender doesn’t automatically guarantee this either.

Remortgaging – stick or twist?

If you’re looking to remortgage, it will have been a few years since you last went through the process. Your circumstances may have changed during this time, not to mention the changes that have happened to the mortgage market. We all know nothing stays the same, so why should your mortgage? It’s fine for something that worked a few years ago, to not fit quite so perfectly now.

We suggest seeking the help of an experienced mortgage adviser to help with your next remortgaging steps. We have access to a huge variety of mortgage options as well as an extensive panel of lenders. We’ll be able to access specialist search tools to help with the process. We can even find exclusive mortgage options with lenders that you may not have access to.

Take the weight off your shoulders with specialist help.

An adviser can be an invaluable guide to the variety of mortgage options out there, protecting your time and energy.

As well as using our in-depth knowledge of the mortgage market to search the thousands of deals out there, we can protect your time and energy, doing the legwork to find your mortgage match.

It might seem daunting looking at the mortgage market now, particularly against a less-than-positive financial climate. It may feel especially tricky if a change in your personal circumstances make you feel like your options are limited – such as a credit blip or redundancy. But it’s important to remember that there are thousands of mortgage choices out there – whatever your situation. And with an expert by your side, you’ll find one that suits you.

We know things may change, and we’ll be right by your side if they do.

If your mortgage expiry date is under six months away, you can secure a new deal now. This means you can spend your time finding the right deal, without rushing to meet the deadline of your mortgage expiring.

One final thing to remember when it comes to remortgaging, is that it isn’t just about comparing the mortgage interest rate, but the mortgage fees that your current lender will charge. If you’re looking to pay less in the long term, then it’s vital to look at the two of these together.

See what mortgage is right for you with an adviser from Finhawk Mortgages Ltd.

Your time and energy is precious, so why not let an adviser from Finhawk Mortgages Ltd do the remortgaging legwork for you? We’ll search and compare products on your behalf to find the right deal for you.

Not only that, but once we’ve found it, we’ll help you through the whole remortgaging process – from scrutinising the small print, to making sure all your paperwork is in order, saving you unnecessary hours spent searching and mortgage comparison headaches.

Our expert advice will make your mortgage search and application process pain-free, and our inside knowledge will protect you from any nasty surprises. So are you ready to find a mortgage that’s right for you? Get in touch with us today.

Call David on 07774 127179 or drop an email to dbeach@finhawkmortgages.co.uk

Approved by The Openwork Partnership on 27/04/2023

Think twice: Why cancelling your financial protection during the current cost of living crisis could be a bad idea

Centuries ago, Benjamin Franklin announced that “By failing to prepare you are preparing to fail”.

This is especially true when it comes to ensuring your personal finances are protected from the rainiest of days. However, with the rising cost of living likely putting pressure on your spending, you may be considering cancelling your cover, even when this could leave you more vulnerable than before. Read on to discover some of the reasons you should consider prioritising your financial protection over other cost of living worries.

Rising costs should highlight the necessity of financial protection

A recent survey by Which? has revealed that 65% of households have resorted to cutting back on essentials, selling items, or dipping into savings to pay their rapidly rising bills.

Financial protection products such as life insurance, income protection, and critical illness cover are sometimes the first things that people decide to cancel when things are tight.

However, without financial protection, one unexpected event or serious illness could plunge you into having to deal with a crisis with no financial support in place.

Life insurance means your family will not face financial hardship

Keeping your life insurance policy can ensure your family benefit from financial support if the worst happens.

Without protection in place, your family could perhaps no longer afford their regular outgoings, leaving them in a difficult financial position at what will already be a stressful time.

Cancelling your policy could jeopardise the financial security of your loved ones.

If you’re the main breadwinner, without your contribution to the household, your family may struggle to meet their regular financial commitments.

Income protection could support you while you’re unable to work

Injury, illness, or an accident could prevent you from working and earning your living at any time, making it hard to meet everyday expenses.

Even if you receive Statutory Sick Pay (SSP), paid at £99.35 a week in 2022/23, it may not be enough to cover your usual expenses and could force you (and your family) to adapt your lifestyle while you recover. Moreover, if you’re self-employed, you aren’t eligible for SSP.

Income protection could save you from such stress. If illness or injury prevent you from working, you can expect to receive up to around 60% of your wages.

Just as important as a payout, an income protection plan could give you access to rehabilitation services that grant you the ability to work again. As an example, 78% of Aviva customers who had rehabilitation support returned to work.

You could receive cover during a critical illness

If you cancel your critical illness cover to save money, you could find yourself out of pocket if you’re diagnosed with a serious condition. You may have to take an extended period off work on a significantly reduced income.

Critical illness provides a lump sum if you are diagnosed with a specified illness such as the following: Heart attack / Stroke / Cancer / Multiple sclerosis

Conditions may vary between providers.

While it’s unpleasant to think about, you should consider your own circumstances and whether you might be vulnerable if you cancel.

Having protection to offset unexpected healthcare expenses could be essential to preserving your financial wellbeing.

You may not feel you need insurance in all the areas discussed here. For example, some employee benefit packages include life insurance, so it’s worth checking to see if this is something you already have through your work.

The type and level of protection that is most suited to you will depend on your circumstances. We can help you decide what would provide you and your family with the most benefit and help you understand which policy is right for you, too.

Potential consequences

If you cancel your protection now with the intention of taking out cover again when your finances permit, you may find the premiums are significantly higher – especially if your health has deteriorated since you took out your original protection. You may also find there are exclusions based on pre-existing conditions.

The short-term savings often may not be worth the potential long-term vulnerability you cause yourself.

Your pension could be your “secret weapon” of protection

According to Pensions Age, 86% of savers are not on track to achieve their retirement expectations.

This serves as a caution that foregoing pension contributions could leave you short when it comes to your retirement funds.

So, pausing or cancelling your contributions now could have a negative effect on the size of your pension pot when you come to retire. This may leave you having to compromise on your later-life plans.

Discussing your pension with us could help to prevent overspending or under budgeting that may affect the funds you’d like use for your retirement.

Get In Touch

We can help to assess your financial wellbeing and assist in finding the right protection for you. This can help to safeguard your finances when confronted with unexpected circumstances. Please get in touch to discuss your needs.

Life insurance plans typically have no cash in value at any time and cover will cease at the end of the term.

If premiums stop, then cover will lapse.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028).

The tax implications of pension withdrawals will be based on your individual circumstances.

HM Revenue and Customs practice and the law relating to taxation are complex and subject to individual circumstances and changes which cannot be foreseen.

Tax concessions are not guaranteed and may change in the future.

Tax free means the investor pays no tax.

Approved by The Openwork Partnership on 14.02.2023

Why your mortgage term matters

With increases in the cost of living impacting on many household budgets, the cost of your monthly mortgage payment continues to be important.

On a capital repayment mortgage, the quicker you pay off your balance, the bigger your monthly payments will be. By having a longer term, you may benefit from a lower monthly payment, but you will also pay more interest.

Whether you’re taking out a new mortgage to buy your first home or have had a mortgage for several years and want to remortgage, it’s important to consider how soon you want to be ‘mortgage free’. You should weigh this up against a mortgage term that makes your monthly repayments affordable.

We can help guide you through all your mortgage options including advice on the term of your mortgage.

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE

Approved by The Openwork Partnership on 30/01/2023

It's not all fixed rates

19 December 2022

With over 10 years of record low interest rates, fixed rate mortgages offer borrowers the stability of knowing what the mortgage payment will be for a set period, which helps with budgeting.

Because of the way many lenders decide what rates to offer, we’re currently seeing tracker products priced a lot more competitively than fixed rate products.

Unlike a fixed rate, the monthly payment of a tracker mortgage fluctuates and the rate charged on the mortgage ‘tracks’ the Bank Rate usually for a set period. Whilst you may have to pay a penalty to leave your lender, especially during the tracker period, there are tracker products that have no early repayment charge, so you are free to leave without penalty.

If you’re coming up to the end of your fixed-rate and you’re faced with a higher interest rate than you were expecting, switching to a tracker at a lower rate may be tempting. Although you may find there are cheaper tracker products on offer than current fixed rates, you must be confident that you’ll be able to afford your repayments if the rate goes up.

We can help guide you through all your mortgage options including advice on whether a fixed rate or tracker product is more suitable.

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE

The benefits of making overpayments on your mortgage

19 December 2022

Hardly a day goes by without the cost of living hitting the headlines. For many homeowners the increasing costs of owning and running a home is having a huge impact on household budgets. For those borrowers with a fixed rate mortgage, the recent increase in mortgage interest rates may not have an immediate impact. However, as mortgages are more expensive now than they were two years ago, you may see your mortgage payments rise when you next come to remortgage.

Overpaying on your mortgage now could save you more on interest down the line and help reduce your mortgage payments. It could also make sense to overpay on your mortgage rather than keep your money in a savings account, because you’ll earn more in interest savings on your mortgage than you could earn in a typical savings account.

An overpayment is any additional payment you make over your usual monthly mortgage payment. Overpayments can either be a one-off lump sum or a regular overpayment made throughout the year. Overpaying on your mortgage means you can potentially clear your mortgage balance quicker.

Lenders will offer you better rates if you have a lower loan to value. The more you can pay to reduce your mortgage, the potentially lower interest rates you’ll have when you come to remortgage to a new deal.

Overpaying on your mortgage might not be right for everyone. Using savings to overpay on your mortgage could leave you with less cash to fall back on in an emergency.

Not all lenders have the same rules for overpaying and there may be a penalty fee called an Early Repayment Charge if you overpay too much.

You should only make overpayments if you’re sure you can afford them. It’s a good idea to make overpayments if you already have an emergency fund, and you don’t have any other, more pressing debts that need to be repaid.

We can help guide you through all your mortgage options including advice on making overpayments.

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE

The Value of Mortgage Advice

Mortgages - Sorting the fact from the fiction

Lindsay and Sam have just found out they’re expecting their first baby. Although they’re excited at the prospect of starting a family, it’s come as a bit of a surprise and their current living situation is far from ideal. They’ve been staying with Lindsay’s dad in his two-bedroomed terrace for just over a year while they save up a deposit for their first house. The lack of space and privacy has proved challenging to say the least. Adding a baby into the mix seems like a terrible idea.

On the positive side, Lindsay and Sam now have a decent deposit to put down on a house. Despite this, friends have warned the couple they’ve no chance of getting a mortgage due to their working situation. Sam is a self-employed roofer and he’s pretty successful. However, he’s only been working for himself for two years. His friends have told him, he’ll need at least three years of accounts before a lender will go anywhere near him. They say any mortgage the couple can get will be based on Lindsay’s income alone. Lindsay works as a hairdresser and her salary is nowhere near enough to secure the kind of mortgage they’re hoping for.

What can Lindsay and Sam do?

Should they resign themselves to bringing up their baby in Lindsay’s dad’s spare room? Or maybe they should accept that, for now, renting is their only realistic option.

In fact, the best thing Lindsay and Sam can do is stop listening to their friends – no matter how well meaning – and seek help from a qualified mortgage adviser.

But why? What can we tell you that you can’t find out online?

We know the market

If, like Lindsay and Sam, your needs or circumstances are ‘out of the ordinary’, your options may indeed be more limited than those of other buyers. However, this doesn’t mean you don’t have options. We know the lenders who are willing to consider buyers in your situation and we’ll check you’re likely to meet their specific lending criteria before submitting a formal application. This will save you time and avoid unnecessary searches on your credit file.

We look beyond the headline rate

An attractive rate may seem like your best bet when choosing a mortgage but you also need to factor in things like fees, loan conditions and the mortgage term. We look beyond the headline rate and can help you understand how the length and type of loan will affect how much you pay in the long term. We’ll also highlight any additional expenses like administration and booking fees, and valuation costs.

We do the hard work for you

As well as helping you select the right mortgage, we’ll work with you to complete all of the necessary application forms and liaise on your behalf with solicitors, valuers and surveyors. We can also recommend products that provide financial protection should the unexpected happen.

We’re professionally qualified

Unlike many mortgage sellers working for banks and building societies, we’re fully qualified to advise you on a wide range of lenders and products.

Key takeaways:

- Get help from a professional. Don’t rely on friends’ advice. The market is constantly evolving. Things that may have been true when your friends bought a house may not be true now.

- Look beyond the headline rate when choosing a mortgage deal.

- A mortgage adviser can help with more than just choosing the best deal, they can ensure the whole house-buying process runs as smoothly as possible.

Buy-to-let mortgages – what you need to know

Pete has just inherited £35,000 from his grandma and he’s thinking about investing in a buy-to-let property but has no idea where to start. So, what are the key things Pete needs to know?

Is the buy-to-let market a good investment?

Some of Pete’s friends have warned him that the buy-to-let market is still reeling from the effects of the covid pandemic. They claim, with more people working from home, there has been a population shift away from major towns and cities - reducing the demand for rental properties.

However, figures from Zoopla suggest that the buy-to-let market is enjoying something of a resurgence since covid restrictions eased. Demand for rental properties was reportedly up 76% in January 2022 compared to the same month in the previous four years. In addition to this, the stock of rental properties was down 39% on the five-year average, with rents rising sharply. All of this suggests that a buy-to-let property may well be a wise investment for Pete.

Is Pete likely to be accepted for a buy-to-let mortgage?

To be accepted for a buy-to-let mortgage, Pete needs to:

- Own his own home (outright or with a mortgage)

- Have a good credit report

- Earn over £25,000 a year

- Be young enough to pay off the buy-to-let mortgage before he reaches the lender’s upper age limit (generally between 70 and 75 years old)

Pete meets all of these requirements so, in theory, there’s nothing stopping him getting a buy-to-let mortgage.

So what else does Pete need to know about buy-to-let mortgages?

Buy-to-let mortgages are very similar to standard mortgages but there are some key differences Pete needs to be aware of:

- The minimum deposit is typically 25% of the property’s value

- Fees and interest rates on a buy-to-let mortgage tend to be higher

- Most buy-to-let mortgages are interest only, although there are repayment ones available. With an interest-only mortgage, you don’t repay the capital until the end of the mortgage term.

How much will Pete be able to borrow?

The amount Pete will be able to borrow is linked to the rental income he expects to achieve. Lenders usually ask that the rent you receive each month is 25-30% higher than your mortgage payment.

Other considerations for buy-to-let landlords

Pete shouldn’t assume that he’ll always have tenants. It’s important that he’s able to make his mortgage payments during periods the property is unoccupied or rent goes unpaid. He will also need savings for unexpected repair bills such as a broken boiler.

As well as these considerations, Pete needs to make sure he’s thought about how he’ll repay the mortgage. He shouldn’t assume he’ll be able to do this in full by simply selling the property. If house prices go down, there may be a shortfall for him to make up.

Buy-to-let and tax

Pete also needs to consider the tax he’ll have to pay as a buy-to-let landlord. As well as income tax on rent, Pete will be looking at paying capital gains tax on the sale of the property. It’s important that he factors this into his calculations when deciding if a buy-to-let investment is right for him.

The importance of professional advice

If Pete’s still keen to go ahead with a buy-to-let investment, the wisest thing he can do is speak to a professional mortgage adviser. They’ll be able to assess his particular circumstances and explain the options that are open to him.

If you’d like advice on buy-to-let mortgages, we’re here to help.

YOUR PROPERTY MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE.

Home Insurance - What you need to know

One wet and windy evening, Rachel and Nathan decided to take advantage of their newborn, Eli, falling asleep in his Moses basket by getting an early night. Gently picking up the basket from its regular spot in front of the fireplace, they crept upstairs. No sooner had they settled in bed when they heard a massive crash from the living room. They ran back downstairs to find a pile of rubble in the exact spot Eli had been sleeping just minutes earlier.

Aware the incident could have been much worse, the couple were still left with an enormous mess to sort out. High winds had caused the inside of the chimney to collapse. However, Rachel and Nathan’s home insurance provider refused to pay for the structural damage because, according to their terms and conditions, the wind hadn’t been strong enough to constitute a storm. They also refused to replace the living room carpet because the couple’s contents insurance didn’t include accidental damage cover.

So, what can you do to make sure your home insurance provides you with the protection you’d expect when the unexpected happens?

Let’s start at the beginning - what exactly is home insurance?

Home insurance is split into two parts – buildings and contents.

Buildings insurance – this covers the building itself, including walls, floors, doors, windows and the roof. It also covers permanent fixtures such as baths, toilets, fitted kitchens and even wallpaper.

Contents insurance – This typically covers anything that can be taken with you if you move e.g. kitchen appliances and furniture.

Not all home insurance is equal

As Rachel and Nathan discovered to their cost, not all home insurance is equal. Although tempting to simply go with the cheapest option, it’s always best to check the details of any policy you’re considering to see exactly what’s included. For example, some buildings insurance covers garages, greenhouses and garden sheds but some policies don’t.

It's also a good idea to check for exclusions. You may find some insurers won’t pay out for anything considered to be the result of general wear and tear or damage that happens over time, such as damp or rot.

Meanwhile, contents insurance generally has a single-item limit, meaning high-value possessions may need to be named separately. You may also have to pay extra to cover belongings when they are taken outside your home.

Accidental damage cover is something else to think about. Rachel and Nathan decided to do without it. However, if they’d added it to their contents insurance, the cost of replacing their living room carpet may have been covered. According to MoneySuperMarket, mishaps account for over a quarter of all home insurance claims, so accidental damage cover may be worth prioritising.

Reading reviews of insurance providers can also be useful. Most events that result in a claim are pretty stressful, so you don’t need things like poor customer service making matters worse. According to the Association of British Insurers, home insurance prices fell to the lowest levels on record in the first quarter of 2022 meaning you shouldn’t have to pay a fortune for a good policy.

Do you really need home insurance?

Homeowners – although buildings insurance isn’t a legal requirement, most mortgage lenders insist on it. No one is going to force you to buy contents insurance but it can provide valuable peace of mind and combining it with your buildings insurance may save you money.

Renters – you don’t need to worry about buildings insurance – this is your landlord’s responsibility. However, contents insurance may be a sensible idea.

Key takeaways:

- What’s covered by home insurance varies from policy to policy, so you should check what’s included before making a purchase.

- Check the terms and conditions for any exclusions to make sure you’re getting the cover you need.

- Paying extra for accidental damage cover is worth serious consideration with over 25% of claims occurring as the result of mishaps.

- Read reviews before choosing an insurance provider – good customer service can be just as important as cost.

How might rising interest rates affect your mortgage?

The Bank of England has raised interest rates which means bigger mortgage bills for some homeowners.

Since December 2021 the Bank of England raised interest rates from 0.1% to 1.25% to combat soaring inflation.

This move will have a knock-on effect as mortgage lenders raise interest rates in response, which will increase monthly payments for some borrowers.

What does a rise in interest rates mean for your mortgage?

Anyone without a fixed-rate mortgage is likely to see their borrowing costs rise, although how they are affected will depend on the type of product they have. Your adviser can help you assess your mortgage deal and figure out ways to make some much needed savings.

• Only borrowers with a mortgage that moves up or down with the base rate will be affected by the interest rate change.

• This includes tracker mortgages and standard variable rate mortgages (which you revert to when a mortgage deal ends).

Fixed-rate mortgages

Most mortgage holders are on fixed-rate deals so won’t see any change in their monthly payments. This is because the interest rate you pay stays the same for the length of the mortgage deal.

Standard variable rate mortgages

You will usually be moved on to a standard variable rate when your existing tracker or fixed rate mortgage deal ends. For example, if you take out a two-year fixed deal and you don’t remortgage, you will be moved to the lender’s standard variable rate. The rate is likely to be considerably higher than what you were paying before, so your monthly payments will increase, and lenders can raise the standard variable rate whenever they want.

Tracker mortgages

Homeowners with a tracker mortgage will find that their interest rate payments will now go up, but when this happens will depend on their lender. Tracker mortgages are a type of variable rate mortgage that follow the Bank of England’s interest rate. So, when official interest rates go up, the rate on your tracker will rise as well.

As a rule, they do not exactly match the base rate, but are set a level just above it. For example, if the lender’s rate is the base rate +1%, the interest you’d pay in total on your loan would be 1.5%.

Whatever type of mortgage you have, we can advise you about how the interest rate rise might affect you and address any questions or concerns you have.

How to save on your mortgage costs

The best thing you can do is to speak to your financial adviser. For example, if you’re on a tracker mortgage, they will be able to advise whether changing to a fixed-term deal to protect yourself from any further rises is a good idea. They will also let you know about the fees involved when making changes to your mortgage. If you are on a standard variable rate you can switch at any time, so with interest rates rising, your adviser can help you look at available fixed-rate deals.

Homeowners on fixed deals don’t have to worry about their mortgage going up until their current term ends. Most lenders will let you lock into a new deal six months before the current one ends so it’s a good idea to plan.

Whether you’re looking to remortgage or are a first-time buyer, we can help you find the most suitable deal for your circumstances and help keep your costs down.

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON A MORTGAGE OR ANY OTHER DEBT SECURED ON IT

Why homebuyers need to check their credit score

Carly and Steve made serious sacrifices to save a deposit for their first home. To cut costs, they moved from their two-bedroomed flat in the centre of Manchester to a studio flat in one of the less well-regarded suburbs. When the damp and the noisy neighbours got too much, they moved in with Steve’s mum and when her questions about when they were going to start a family got too much, they moved in with Carly’s big sister.

As well as moving home three times in the space of a year, Carly and Steve gave up takeaways, holidays, and their gym memberships. When they finally had enough money for a deposit, they couldn’t apply for a mortgage fast enough. They were crushed when their application was rejected due to a poor credit score.

A good credit score is vital for homebuyers, as this is how lenders assess how much of a risk you pose. The UK has three main credit referencing agencies – Experian, Equifax and TransUnion. They use your personal banking information to assess how well you manage credit. This is summarised in a credit report and by a single number - your credit score. Lots of things can affect your credit score, including moving house frequently, which is seen as a red flag as it can be a sign you’re struggling to pay your rent. So, as well as avoiding frequent changes of address, what can you do to make sure you don’t end up in Carly and Steve’s position?

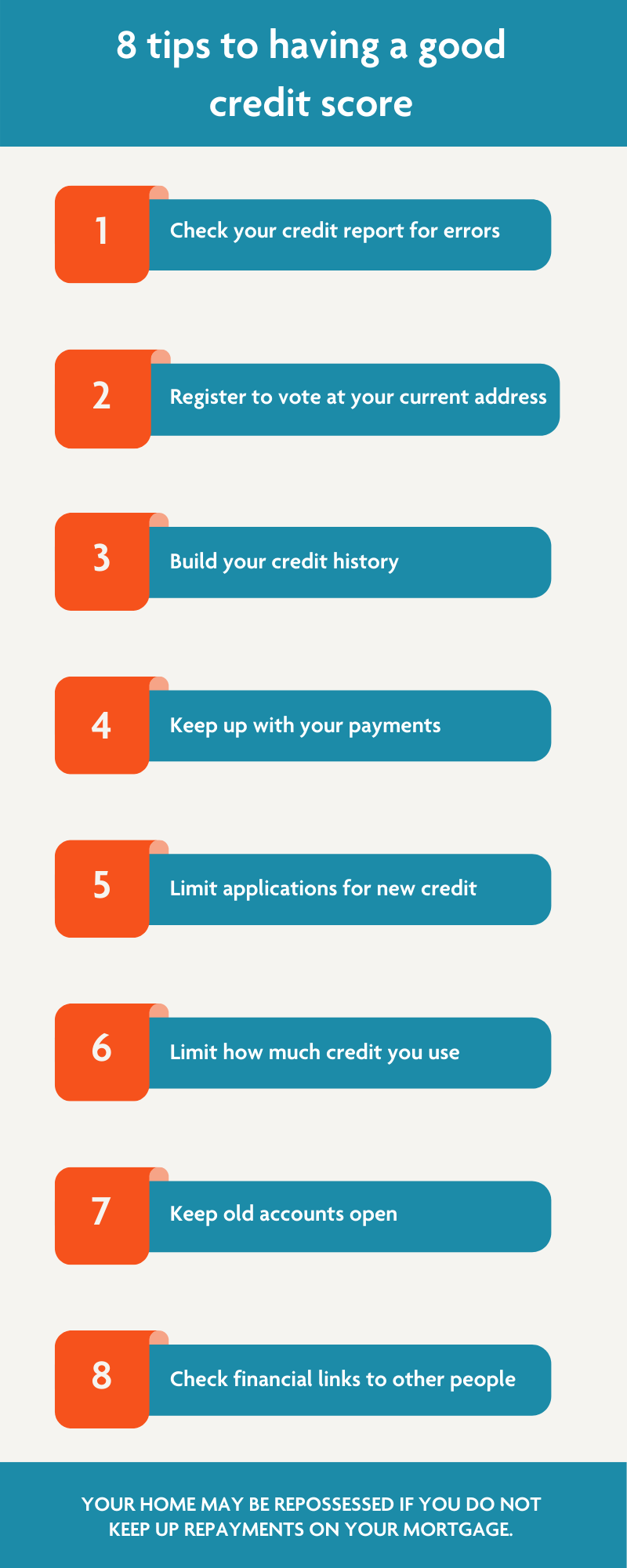

Check your credit report for errors

Even small mistakes, such as a mistyped address, can affect your credit score. If anything looks wrong, contact the credit referencing agency to correct it.

Register to vote at your current address

This proves where you live and can add 50 points to your credit score, according to Experian.

Build your credit history

Having little or no borrowing history may result in a lower credit score. You can build your credit history by opening a current account, setting up Direct Debits or getting a credit-builder credit card.

Keep up with your payments

By avoiding late or missed payments on existing credit accounts, you show lenders you’re a reliable borrower.

Limit applications for new credit

When you apply for credit, your credit report is searched. Too many searches in a short space of time can impact your credit score. Try to avoid applying for new credit – such as a mobile phone contract or a credit card - during the six months before a mortgage application.

Limit how much credit you use

If you have a limit of £1,000 - on a credit card for example - and you’re using £500, that’s 50% of the available credit. If possible, you should try to make sure you’re using less than 30% of all the credit available to you.

Keep old accounts open

It’s good to be able to demonstrate a long credit history and show you’ve successfully managed a number of different credit accounts. Having unused credit on old accounts also helps limit the proportion of available credit you’re using.

Check your financial links to other people

If you opened a joint account with an ex-partner or previous housemates, their poor money management could impact your credit score. Check you aren’t linked to anyone who may have a negative effect on your score and ask for outdated links to be removed.

Whether you’re a first-time buyer or a homeowner looking to move, we can help find the best mortgage for you.

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE.

How does a remortgage work?

A remortgage is the process of moving your home’s existing mortgage to one with a new lender. Remortgaging could help you save money if you weigh up the fees involved with the savings you could make. Here’s how it works.

People remortgage for many different reasons, including:

- Finding a better deal elsewhere – you might be on a standard variable rate (SVR) and want to move to a fixed-term rate.

- Coming to the end of a fixed-term deal on your current mortgage and wanting to lock in a lower rate with a new lender.

- The loan-to-value on the home is lower (as more of the mortgage has been repaid).

- Wanting to get ahead of a rise in interest rates, which would affect mortgage rates.

How a remortgage could help you save

One of the big reasons people remortgage is to save money on their monthly payments. If you’re on a standard variable rate that is higher than the fixed-rate deals currently available, you could save by switching – either to a fixed-rate mortgage or one that ‘tracks’ the Bank of England’s base rate.

If your home has gone up in value and you’ve paid off enough of your mortgage to give you a lower loan-to-value, it means you own more of your home and have less to pay off. Remortgaging could result in lower monthly mortgage payments because you’re paying off less of a loan amount (and in turn, less interest on it too).

How long does the remortgage application take?

The process can take between four to eight weeks from the time you apply so it’s good to start planning early. If you’re coming to the end of a fixed-rate or tracker term, your lender should tell you that your mortgage will move onto their standard variable rate1. This could be an ideal time to move if you find a better deal elsewhere, or you may even find an attractive deal with the same lender and go through a ‘product transfer’ (see box).

How much does a remortgage cost?

- Existing lender fees

Your existing lender could charge you a fee if you’re leaving them early into a fixed period in your mortgage. This is known as an ‘early repayment charge’ and could be in the range of 1% to 5% of your outstanding mortgage balance. They will also charge you an ‘exit’ fee of around £50 to £100 to cover their administration costs. - New lender fees

Your new lender could charge you a range of fees, so before you commit it’s important to check what you will pay. This will help you calculate whether a move is financially beneficial overall.- Their fees could include:

Application fee to set up your new mortgage. Could also be called an ‘arrangement’, ‘product’ or ‘booking’ fee. This could be around £1,000. - Valuation and conveyancing fees. Some providers won’t charge for these, but it’s worth checking if you are moving to a new lender.

- Solicitor’s fee covering the legal paperwork to do with managing the transfer of your mortgage.

- Their fees could include:

Is a remortgage right for you?

Whether or not you remortgage all depends on your situation and the type of mortgage plan you’re currently on. You may want a mortgage that lets you make overpayments, or you could be coming to the end of your current deal’s fixed term and think the lender’s SVR will be too high. One of the most important things you can do before you decide is gather your current mortgage paperwork, look at the fees and get some expert advice on your next steps.

What about product transfers?

If your mortgage is coming to its maturity date but you’d prefer to stay with your current lender, you could consider a product transfer. Switching to a new mortgage product with the same lender could save you money and time.

Our financial advisers can help guide you through choosing the option for you.

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE

Protect your peace of mind when moving home

Moving home can be a hectic and exciting time, but don’t forget about protection – taking out the appropriate policies can save you a lot of stress in the long term.

If you’ve just moved home or are about to, it probably feels like you’ve been caught up in a bit of a whirlwind over the past few months. With searching for a property during a pandemic, making the move before the stamp duty holiday ends and potentially getting caught up in the resulting conveyancing backlog, protection policies are probably not top of your priority list.

Yet it’s important to take the necessary precautions to ensure your new home and possessions are looked after – now more than ever. Here are some of the main types of protection you should be thinking about.

Mortgage protection

If you’re unable to work due to illness or injury or because you’ve lost your job, mortgage payment protection will cover the cost of your mortgage each month. These policies usually last for a year or until you return to work – whichever is soonest.

You can pick how much you want your policy to pay out each month, and this can include a buffer for other expenses, such as bills. It’s important to bear in mind though that providers usually set monthly limits of between £1,500 and £2,000. You won’t always be able to claim straight away, and there’s usually a waiting period of one or two months. The cost of mortgage protection will depend on:

- your salary;

- the size of your mortgage repayments;

- the type of policy you choose; and

- how soon you want to be covered.

Income protection

Income protection provides you with a regular income if you are unable to work due to illness or injury. There’s usually a minimum wait of four weeks before you can start receiving payments.

Buildings insurance

If you’ve got a mortgage, you’re likely to have buildings insurance to cover the cost of repairing damage or rebuilding the structure of your home if it’s damaged. But have you looked carefully through the policy and made sure that it definitely covers everything you need it to? Once you’ve moved, you may realise that your new home has a slightly more complex structure than you first realised, and it’s important to make sure your buildings insurance takes this into account. If you’re lucky enough to not have a mortgage, it’s still a sensible idea to invest in this type of insurance for peace of mind.

Contents insurance

If you’ve bought new furniture and gadgets for your home, you might need to review your contents insurance. This type of insurance covers the cost of replacing possessions in your home if they’re stolen, destroyed or damaged. It’s a good idea to double check which of your items are covered so that you’re not caught out if something does go wrong.

Act now

When you’re caught up in the excitement of moving, thinking about protection might be the last thing on your mind. But remember that your circumstances can change quickly and it’s important to make sure you’re prepared now in case things don’t go to plan in the future. For more information about protection and to talk about whether your current policies are right for your situation, speak to your financial adviser today.

Do I really need a survey?

Posted on Monday 6th of September 2021

Do I really need a survey?

Well, the short answer is yes.

Contrary to costs such as legal fees, estate agency fees or Stamp Duty, having your new home surveyed isn’t actually compulsory. However, with a property being the most expensive thing most of us will ever buy, the price of not having it checked by a surveyor could be devastating.

If you buy a property for the seller’s asking price and later find it has serious defects, it’s too late to back out of the purchase or renegotiate a price with your seller. You’re also likely to fi...

5 Steps to being Mortgage Ready

Posted on Monday 30th of August 2021

Protecting you and your family

Posted on Monday 23rd of August 2021

Losing your partner at any stage in life can be devastating, but it may be particularly devastating when children are involved because of the financial pressures of raising a family. Ensuring your children and other dependants are provided for in case you die should be a top priority but less than a third of people in the UK have life insurance.

Keep it simple

Many products are available but a simple level-term policy, where a pre-decided lump sum is paid out should you die within a stated period, is among the simplest to arrange and is typi...

Now could be a good time to remortgage

Posted on Monday 16th of August 2021

Mortgage rates are now at record low levels. Borrowers on a tracker, discounted or variable rate mortgage may have already benefited from this rate drop, but those borrowers whose mortgage deal is nearing its end, or those currently on an uncompetitive standard variable rate (SVR), should review their situation as there are some very competitive products on the market, with potential savings to be had.

Remortgaging explained

A remortgage is where you take out a new mortgage on a property you already own - either to replace your existing mo...

How secure is your business?

Posted on Monday 9th of August 2021

How secure is your business?

Business protection is a crucial element in a company's financial future, but how many have cover in place?

You may have covered the tangible assets in your business, but have you protected the most important asset; the people who contribute directly to your bottom line?

If the answer is no, you could be putting your business at risk. After all, if you lost a key employee, this could impact the day-to-day running of the business, it could hit profits and create problems repaying an outstanding busine...

Armed Forces Mortgages

Posted on Monday 2nd of August 2021

We support our servicemen and women to get on the property ladder. There are opportunities to achieve home ownership, expand your home or move to another property.

Read our Director, David Beach, in the Spring 2020 edition of Army&You magazine (p. 40).

Below is an outline on UK armed forces mortgages and how we can help.

Help with Armed Forces Mortgages

Everyone has challenges with getting on the property ladder, however, these may be more taxing if you have been deployed to different areas in the UK or wider world. To manage this and a...

Be vigilant and scam smart

Posted on Monday 26th of July 2021

Warnings from a number of UK bodies, including the Bank of England, Financial Conduct Authority, National Crime Agency and Action Fraud have urged people to be vigilant about scams by fraudsters who are taking advantage of people’s fears and capitalising on the COVID-19 crisis.

Huge increase in cases

Action Fraud has released figures showing that reports of scams had increased by 400% in March. The majority of reports concerned online shopping scams, with victims purchasing protective products (such as hand sanitiser or face masks) that fail...

Our expert advice could help reduce mortgage stress

Posted on Monday 19th of July 2021

Moving home is known to be one of life’s most stressful events. In fact, a survey earlier this year, found the process can cause us more stress than other major life events such as having a baby, getting married, starting a new job or getting divorced.

Sorting out your finances

The biggest cause of worry for many is arranging finance for the move. First-time buyers need to save up funds for a deposit, as well as finding the right mortgage and an affordable property. Low-deposit mortgages and saving schemes, like the Help to Buy ISA (which ...

Mortgage advice for employees

Posted on Monday 12th of July 2021

Research suggests that involvement in employee financial wellbeing could contribute to higher organisational performance and productivity.

As mortgages are likely to be the single largest financial commitment, averaging 17.5% of gross household income, provision of mortgage advice makes good sense.

Financial wellbeing can be improved through better mortgage understanding and reviews. Saving money through sourcing better deals and improving control is of benefit to both employees and businesses.

The Growing need for business protection

Posted on Monday 5th of July 2021

There’s never been a more important time for business owners to consider buying business protection as part of its risk management.

While larger businesses are likely to have well-developed succession plans, smaller businesses will be more vulnerable should they lose the services of a key person or be presented with business loans through death or a critical illness.

Relevant Life Plans are considered as Business Protection, but it’s actually death in service (DIS) life cover for employees. The life insurance is taken out and paid for by the...